Call Today! (503) 308-7767

Benefits For Our Veterans.

There is a little-known Veterans benefit that could provide thousands of dollars each year to help cover the cost of care. The Department of Veterans Affairs offers this special pension benefit to wartime Veterans and their surviving spouses, yet many who qualify are unaware it even exists.

As someone who once wrote a blank check to the United States of America for an amount “up to and including your life,” you have earned every resource available to you. At Fortis Planning, we are honored to share this program with Veterans and their families so they can receive the support they deserve.

Thank You For Your Service!

Your service to our country is deeply appreciated, and at Fortis Planning we are committed to helping you and your family access the benefits you have earned. One of the most valuable yet little-known programs is a tax-free pension benefit designed to provide financial assistance for long-term care. This support can be used whether care is provided in your home, in an assisted living facility, or in a nursing home.

The benefit is available to wartime Veterans and surviving spouses who require the regular assistance of another person with at least two Activities of Daily Living. These may include help with bathing, dressing, eating, toileting, or transferring. By securing this benefit, you and your family can reduce the financial burden of care while ensuring that your needs are met with dignity and support.

How to Know if You Qualify

You may be eligible for this Veterans benefit if you are a wartime Veteran or the surviving spouse of a wartime Veteran and are over the age of 65. Eligibility also depends on your current or anticipated care needs. If you require assistance with at least two Activities of Daily Living, such as bathing, dressing, eating, toileting, or transferring, you may qualify for this program.

It is also important to consider your current VA Disability benefits. If you are receiving a monthly disability check greater than the amount of the Long Term Care Benefit, you may not be eligible. Our team can help you review your situation and determine whether this benefit is available to you or your loved one.

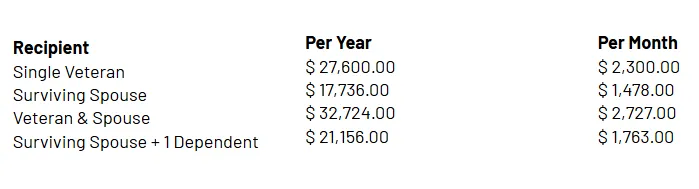

Veteran’s Long-Term Care Benefit Value

Understanding these requirements before you need the income is paramount. We can help you get your well-deserved TAX-FREE BENEFIT. The above numbers are as of November 27, 2024.

VA BENEFITS, PENSIONS & MILITARY RETIREMENT

One of the best-kept secrets available to Veterans and their families is the Aid and Attendance Benefit. This tax-free pension program can provide significant financial assistance to those who qualify, yet many Veterans are unaware it even exists. At Fortis Planning, we are committed to spreading the word and helping those who served—and their families—position themselves to take advantage of this valuable benefit.

It is important to understand that VA pensions and military retirement pay are not the same. The Aid and Attendance Benefit is specifically for wartime Veterans who were not dishonorably discharged and who have a qualifying financial need. To qualify, you generally must be age 65 or older, permanently disabled (not due to your own misconduct), receiving skilled nursing care, or receiving Social Security disability benefits. Additionally, your yearly family income must fall below the amount set by Congress.

Many people mistakenly believe they must be impoverished to qualify. This is not true. You do not need to have service-related disabilities, and while net worth is a factor, proper planning can make all the difference in meeting eligibility requirements. As with all estate planning, timing matters. With the right strategy, Veterans and their spouses can legally and effectively prepare to qualify before care is needed.

HOW DO YOU QUALIFY FOR THESE VETERANS BENEFITS?

To qualify for the Aid and Attendance Benefit, a Veteran or surviving spouse must meet the net worth limit of $155,356 as of December 1, 2023. This threshold is adjusted annually to account for cost-of-living increases.

Eligibility also requires a review of financial history. The Department of Veterans Affairs applies a three-year “look back” period to determine if assets were transferred in order to meet the net worth requirement. If assets were given away or transferred during that time, the applicant may face a penalty period of ineligibility that can last up to five years.

At Fortis Planning, our team will help you evaluate your financial situation, determine whether you qualify, and develop a strategy if adjustments are needed. With proper planning, you can position yourself to receive this valuable pension benefit at the time you need it most.

Take the First Step Today!

Don’t leave your future to chance. The decisions you make today shape the legacy you leave tomorrow. Our team of dedicated estate planning professionals is here to guide you through the process with clarity, care, and expertise. Whether you’re looking to protect your loved ones, preserve your assets, or minimize tax burdens, we’re committed to providing solutions tailored to your unique goals.

Here’s what you can expect from your complimentary consultation:

A Comprehensive Review of Your Needs: We’ll take the time to understand your financial and family situation, your goals, and your concerns.

Clear Explanations: Estate planning can feel overwhelming, but we simplify the jargon and outline your options in straightforward terms.

Tailored Strategies: Whether it’s asset protection, tax advantage accounts, or veterans’ trusts, we provide recommendations that align with your specific circumstances.

A Path Forward: You’ll leave with a clear understanding of your next steps and how we can support you in achieving your estate planning goals.

Why Wait? Your Future

Deserves Attention Now.

Don’t leave your future to chance. The decisions you make today shape the legacy you leave tomorrow. Our team of dedicated estate planning professionals is here to guide you through the process with clarity, care, and expertise. Whether you’re looking to protect your loved ones, preserve your assets, or minimize tax burdens, we’re committed to providing solutions tailored to your unique goals.

Fortis Planning, LLC is not a law firm and does not provide legal advice. All documents are reviewed by licensed attorneys in the appropriate state.

Copyright 2025. Fortis Planning, LLC. All Rights Reserved.